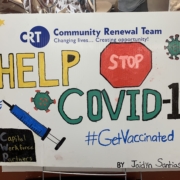

Need Help with Your Mortgage Payment Due to COVID-19? Connecticut Homeowners That Meet Eligibility Guidelines May Receive Up to Four Months of Mortgage Assistance from CSBG Cares Act Emergency Resource Fund

Hartford – The Community Renewal Team (CRT) is alerting area homeowners that they may be eligible for up to $8,000 in mortgage payment assistance through the Community Services Block Grant (CSBG) Cares Act Emergency Resource Fund. These relief payments represent a combination of two months short-term mortgage payment assistance; and up to two months for mortgage arrearages, for a total of four months’ worth of possible mortgage payments for qualified individuals.

“It is our goal to help as many households as possible access this valuable mortgage assistance program,” said Christopher McCluskey, Vice President for Housing & Community Services at CRT. “One of the most important services we can provide is to assist homeowners protect the assets they worked so hard to obtain, first by helping to address their immediate crisis, and then working on a long-term plan to ensure families remain stably housed.”

There are specific criteria to qualify for this mortgage assistance, including:

- Annual total household income does not surpass 200% of the federal poverty level (FPL).

- Sample Income Criteria:

1 Person household = $25,760/year

2 Person household = $34,840/year

3 Person household = $43,920/year

4 Person household = $53,000/year

5 Person household = $62,080/year

- Individuals and families impacted by COVID-19.

- Expenses incurred as of, or after, April 1, 2020.

- Individuals and families must reside in CRT’s core catchment area (Hartford County or Middlesex County).

Since these funds are from the Community Services Block Grant (CSBG), both qualified immigrants and non-qualified immigrants may be eligible for this program if they meet eligibility requirements.

These funds are meant to be used as the payer of last resort in the event there are no other agency and/or community resources available, or due to the immediate nature of the emergency.

In addition to income eligibility, CRT staff will work with mortgage assistance applicants to document verification checks with 211 and other community resources. This will help to ensure that resources from other state departments/organizations are not available to cover the same type of assistance.

When meeting with CRT’s Foreclosure Prevention Housing Counselor, homeowners will have the opportunity to learn about other forms of financial support that may be available.

Mortgage assistance funds for eligible homeowners will be transmitted directly to the lender/mortgage holder.

For more information about how to apply for this mortgage payment assistance, please contact: Herman Gibson, CRT Foreclosure Prevention Housing Counselor, by phone at 860-761-2381 or email at [email protected].

For more information, please contact CRT’s Communications Director, Jason Black at 860-230-4535.

###